Introduction

The economic landscape of Afghanistan has undergone significant changes since the Taliban assumed control in August 2021. Amidst claims of economic improvement by the Taliban, there remains widespread skepticism regarding the veracity of these assertions. This blog delves into the state of Afghanistan’s economy before and after the Taliban’s takeover, assessing key economic indicators such as GDP, inflation, foreign direct investment (FDI), unemployment, and foreign reserves through the lens of international reports.

Overview of the Economy Before the Taliban Takeover

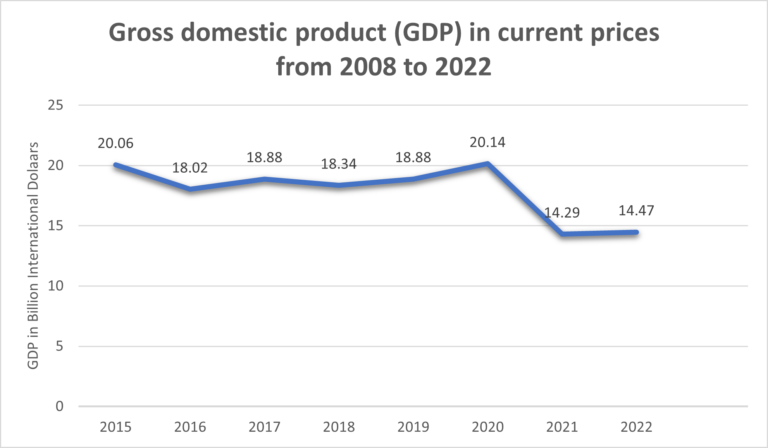

Prior to the Taliban’s return to power, Afghanistan’s economy was grappling with significant challenges. According to the International Monetary Fund (IMF), the country’s GDP growth rate had slowed to 3.9% in 2020, down from 4.2% in 2019. Inflation was on the rise, with the World Bank reporting an annual inflation rate of 5.6% in 2020.

“Aid cuts have crippled public services, leading to widespread unemployment and poverty.” World Bank report

Foreign direct investment (FDI) had dwindled to a mere $39 million in 2020, a staggering 92% decline from the previous year. Unemployment remained a persistent issue, with the Asian Development Bank (ADB) estimating an unemployment rate of 23.9% in 2020. Moreover, Afghanistan’s foreign reserves had dwindled to critically low levels, standing at $9.2 billion as of April 2021, according to the International Monetary Fund.

“The financial and economic isolation has caused a collapse of the banking system and a severe liquidity crisis.”

Vanda Felbab-Brown, Senior Fellow at the Brookings Institution

Current Economic Conditions

Under Taliban governance, Afghanistan’s economic conditions have continued to deteriorate according to various international reports. The IMF estimates that Afghanistan’s GDP contracted by 30% in 2021 following the Taliban’s takeover. Inflation has surged, reaching an estimated 18% in 2022 as reported by the World Bank, driven by supply chain disruptions and reduced domestic production . Foreign direct investment has nearly vanished, with the ADB reporting negligible inflows as international investors remain wary of the unstable political climate.

The Taliban’s hardline policies, especially regarding women’s rights and media freedom, have alienated potential investors and donors.”

Graeme Smith, Senior Consultant at the International Crisis Group

Unemployment has worsened significantly, with the United Nations Development Programme (UNDP) estimating that up to 97% of the population could fall below the poverty line by mid-2022. Foreign reserves have dwindled, with estimates suggesting they have fallen below $3 billion as the international community has frozen Afghan assets abroad and suspended financial aid. The Taliban’s lack of access to these funds has exacerbated the economic crisis, leading to severe liquidity issues and crippling the country’s ability to import essential goods.

Afghanistan’s economy is facing a severe contraction, with the potential for extreme poverty rates to increase drastically.”

United Nations Development Programme (UNDP) report

Reasons for Lack of Economic Improvement

Several factors contribute to the lack of economic improvement under Taliban rule.

Firstly, the international community’s sanctions and the freezing of Afghan assets have severely limited the Taliban’s ability to manage the economy effectively. As noted by Vanda Felbab-Brown, a senior fellow at the Brookings Institution, “The financial and economic isolation has caused a collapse of the banking system and a severe liquidity crisis.”

Secondly, the drastic reduction in international aid, which previously accounted for nearly 40% of Afghanistan’s GDP, has left a gaping hole in the national budget. According to the World Bank, “Aid cuts have crippled public services, leading to widespread unemployment and poverty.”

Thirdly, the Taliban’s governance style and lack of international recognition have deterred foreign investment. As highlighted by Graeme Smith, a senior consultant at the International Crisis Group, “The Taliban’s hardline policies, especially regarding women’s rights and media freedom, have alienated potential investors and donors.”

Fourthly, ongoing security concerns and insurgent activities have further destabilized the economy. The continued presence of extremist groups has disrupted trade routes and hampered economic activities, leading to significant losses in agricultural and industrial output

Positive Measures by the Taliban

Despite the overall grim economic scenario, there have been some positive measures taken by the Taliban that deserve mention. The Taliban have attempted to streamline tax collection and reduce corruption, which were rampant under the previous government. According to local reports, the new administration has made efforts to reopen schools and healthcare facilities, though these efforts are limited by financial constraints.

Moreover, the Taliban have initiated several infrastructure projects aimed at improving transportation and connectivity within the country. For instance, they have announced plans to rehabilitate major highways and improve the electricity supply, which could potentially boost economic activities in the long term. These efforts, although nascent, demonstrate a willingness to address some of the infrastructural deficits that have long hindered Afghanistan’s economic development

Conclusion

The assessment of Afghanistan’s economy under Taliban governance remains a complex and multifaceted issue. While global reports paint a bleak picture, with economic indicators pointing towards a deteriorating situation, the true extent of progress or regression remains to be seen. Ultimately, the Taliban’s ability to garner international recognition, address brain drain, restore trade and supply chains, and instill investor confidence will be crucial in determining the nation’s economic trajectory. As the world watches closely, Afghanistan’s economic future hangs in the balance, with the Taliban’s governance and policies being put to the test